by Rona Fried

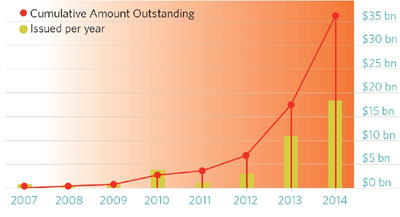

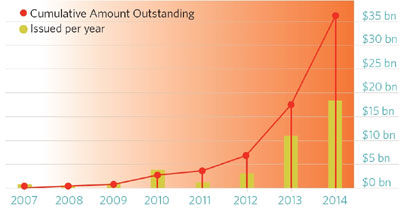

At the end of 2013, seemingly out of nowhere, the market for green bonds took off, all of them over-subscribed.

From a meager $2 billion issued over several years, we ended the year with $11 billion in newly issued bonds, spurring many bankers to call it a tipping point.

And indeed it is, because this year it’s been near-impossible to keep up with them all as the market exploded from niche to mainstream – with almost $20 billion issued in 2014. It’s expected to reach $40 billion by year-end, and then skyrocket to $100 billion in 2015!

In March, the Solactive Green Bond index launched on the Frankfurt exchange, opening the door to green bond exchange traded funds (ETFs). It currently includes about 33 bonds at $100 million or more.

This is for bonds that are labeled as "green." If we look at the broader universe of unlabeled bonds that finance climate change solutions – it stands at $503 billion, up from $346 billion last year. The majority fund low-carbon transport, notably rail (71%), clean energy (15%) and climate finance (10%).

Pioneered by development banks, we’ve now seen green bonds also issued by corporations and municipalities around the world.

At the same time, there’s been a focus on setting verifiable standards for green bonds, to make sure there’s no greenwashing.

The ultimate goal is to provide the financing necessary to keep global temperature rise below 2 degrees C – $5 trillion in renewable energy alone by 2020, according to the International Energy Agency (IEA). And that’s above "business-as-usual" investments of incentives and loans.

Watershed Bonds

In early 2013, development banks IFC and EIB issued landmark bonds that got the balling rolling at $1 billion and EUR650 million respectively.

Late in the year, three watershed corporate bonds followed from Bank of America, Électricité de France (EDF), and Vasakronan (Swedish real estate firm). EIB remains the single, largest issuer at $3.53 billion, and now the majority of bonds are coming from corporations. And they have all been at least three times over-subscribed.

GDF Suez issued the largest corporate bond to date at $3.5 billion – and was oversubscribed in two hours! It’s linked to "renewable energy and energy efficiency projects that fight climate change."

Among the corporations that have issued green bonds are: Toyota ($1.7 billion!), SolarCity ($300 million), TD Bank ($462 million), Unilever ($411 million), and Skanska ($131 million).

Because of demand, Toyota’s upsized the offer from $1.25 billion, linking it to hybrid and electric vehicle loans; Unilever is the first to link it to reducing its climate footprint; and Skanska to invest in commercial green property development. SolarCity’s is linked to its solar leasing portfolio, recently raising $201.5 million in its third bond offering in eight months. Banks link their bonds to loans for climate and environmental-related projects.

- German’s development bank, KfW, jumped in with a whopper at $2 billion, linked to its environmental and renewable energy investing programs.

- World Bank: $1.3 billion – efficiency and renewables; waste; agriculture that cuts emissions; forest and watershed management; resilience – to be sold to Japanese retail investors.

EIB: $480 million, 5-year Climate Awareness bond, for efficiency (cogen, building retrofits, energy loss in transmission) and renewable energy.

-

Taiwan-based Advanced Semiconductor Engineering issued

Asia’s first corporate bond – $300 million, 6-year bond – 6-times oversubscribed, it will finance its transition to low-carbon and climate resilient growth. -

Arise Windpower: $167 million, 5-year bond to re-finance wind farms in Sweden.

- Bond issued to finance two sustainable hospitals in British Columbia – $218 million, 32 years, AAA, over-subscribed.

- Water Projects:

District of Columbia Water closed the first 100 year bond to finance water quality and resiliency projects; New York State Environmental Facilities Corp’s $213, 25 year bond provides help for local government drinking water

projects. - Utilities:

Iberdrola (Spain): $1 billion, 5-years to re-finance existing assets and new smart grid and renewable energy projects; Italian utility Hera: EUR 500 million, 10 year

corporate bond

In January, the market got a boost when 13 banks issued Green Bond Principles, including Citi, Bank of America and JP Morgan. Endorsed by a dozen others, they set standards for what can be called a "green" bond and the kind of reporting needed for it to be credible.

Clean Energy Victory Bonds Act of 2014 has been introduced in the US for the second time – it sure would be great if got some attention.

Read my column in Solar Today about last year’s rush of green bonds.

Here’s the 2014 edition of Bonds and Climate Change: the State of the Market: