by Rona Fried

Low oil prices are having a huge impact and the good news keeps adding up, as the most risky, expensive oil and gas projects are ditched (for now).

Chevron just put its plan to drill in the Arctic’s Beaufort Sea on indefinite "hold" because of "economic uncertainty in the industry," reports Reuters.

A joint venture between Imperial Oil, Exxon and BP is assessing the situation, and they too could drop plans for drilling in the Beaufort Sea.

So far, Shell isn’t giving up, however, and insists it will drill in Chukchi Sea next year. It re-hired Noble Drilling to do it, even after it pled guilty last week to eight felonies – agreeing to pay $12.2 million – for its botched attempts in 2012. Felonies include improperly discharging oily water into the ocean and covering up or neglecting to report a litany of engine and other system failures that it knew about before it arrived in the Arctic Ocean.

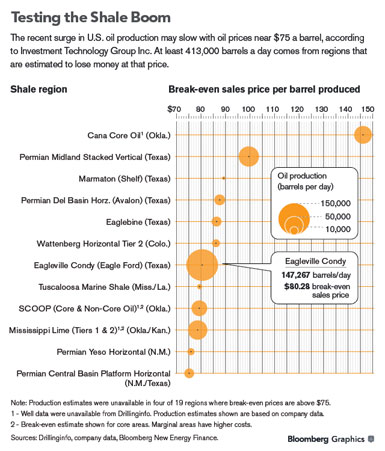

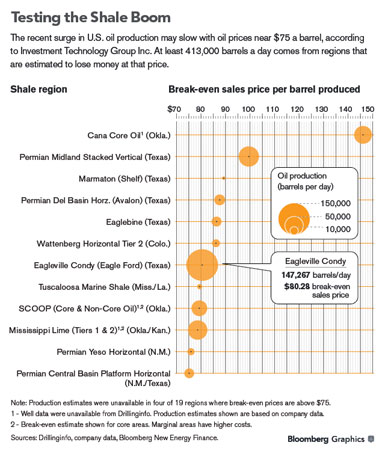

On the fracking front, an amazing 550 drilling rigs will go quiet in the next two months – a quarter of all the rigs in the US! There’s already been a 40% drop in new drilling permits over the past two months, reports Fuel Fix. Goldman Sachs says the oil industry should expect to weather a lengthy price downturn.

While many point to the oil boom as evidence against "peak oil," it’s important to remember that most of world production no longer comes from conventional, easy-to-extract oil; it comes from fracking, tar sands and deep water drilling, which isn’t profitable unless oil prices are high. Even at $55-$60 a barrel, petroleum prices are higher than the International Energy Agency projected 10 years ago.

"The shale boom seems to have resulted from a combination of high petroleum prices and easy financing: with the Fed keeping interest rates near zero, scores of small oil and gas companies were able to take on enormous amounts of debt to pay for the purchase of drilling leases, the rental of rigs, and the expensive process of fracking. This was a tenuous business even in good times, with many companies subsisting on re-sale of leases and creative financing, while failing to show a clear profit on sales of product. Now, if prices remain low, most of these companies will cut back on drilling and some will disappear altogether," says Richard Heinberg at Post Carbon Institute.

Indeed, Governor Cuomo’s decision to ban fracking in NY State may be at least partially because of low gas prices. There’s a lot less upside to the state from taxes if gas companies are less profitable, and the state has to pay for roads and other infrastructure, in addition to environmental supervision. An area of Northeast Ohio with large shale deposits has put fracking on hold.

And what about all those Liquified Natural Gas plants the US has been rushing to approve? When the cost of processing and shipping American supplies to Asia – the biggest buyer – is taken into account, shipping oil from the Middle East costs the same, reports Bloomberg.

Avoiding the Worst?

Before prices plunged, we were seeing news after news story about extending fracking to the worst places.

- Even though there isn’t much gas below George Washington National Forest, the US Forest Service is opening part of it to fracking.

- Facing a budget shortfall, West Virginia opened bids for oil and gas drilling 14 miles under the Ohio River, with plans for more. The river provides drinking water for millions of people (and habitat!).

- Near the Arctic Circle, Conoco-Phillips and others have begun exploratory drilling in the Canol shale region, where there could be as much oil as North Dakota’s Bakken formation. Licenses already cover 1.35 million hectares of wilderness, and Canada’s National Energy Board approved TransCanada’s plans to build a $16 billion natural gas pipeline from the Arctic coast to Alberta. The project is on hold because of low natural gas prices.

Last year, there was so much excitement about drilling prospects in the Northwest Terratories there that the local water board decided to not bother with environmental impact assessments for exploratory wells, reports Yale Environment 360.

- Deep water is the final frontier for fracking and there are plans for the US Gulf, South America and Africa coasts. "It’s the most challenging, harshest environment that we’ll be working in, You just can’t afford hiccups," Ron Dusterhoft, a Halliburton engineer told Bloomberg.

Fracking’s Dirty Toll

There’s been so much oil and gas drilling and mining on US public lands, that they no longer can be considered a carbon sink, because they are the source of 4.5 times more pollution than they can absorb. 42% of coal, 26% of oil and 18% of natural gas comes from public lands, onshore and offshore.

Meanwhile, the boom has been taking a huge toll. In addition to the air and water pollution that’s been widely covered, saltwater (a waste product) spills are leaving North Dakota farmland sterile for years. There have been 810 spills in the past year alone, according to Inside Energy.

The water is 10-30 times saltier than ocean water and comes up with the oil from drilling deep underground, along with fracking chemicals, heavy metals and radioactive material. Oil companies are required to pump it back, but there’s so much of it that there are spills, leaks and illegal dumping as we’ve seen with radioactive waste.

And speaking of radioactive material, the US Coast Guard – which regulates waterways – proposes allowing fracking companies to ship wastewater on the nation’s 12,000 miles of rivers and lakes. It’s much cheaper than trucks and exploding rail cars.

In 2012 alone, fracking operations generated 280 billion gallons of toxic wastewater, according to Fracking by the Numbers, by Environment America Research & Policy Center.

Since 2005:

- consumed 250 billion gallons of fresh water

- degraded 360,000 acres of land

- generated 100 million metric tons of global warming pollution

And while we hear about all the jobs the industry creates, Pennsylvania ranks 48th on job growth, one of six states studied in the midst of the boom. "Industry supporters have exaggerated the jobs impact in order to minimize or avoid altogether taxation, regulation, and even careful examination of shale drilling," says Frank Mauro, executive director of the Fiscal Policy Institute.

Read Fracking by the Numbers: