Republicans are moving quickly on their first agenda items, starting with ensuring the Production Tax Credit (PTC) – so critical to the wind industry – doesn’t get renewed.

The industry is simply too successful and they want it to go away, as well as state Renewable Portfolio Standards that support it.

After Republicans filibustered a bill this spring, Senate Majority Leader Harry Reid (D-NV) promised to get it to the floor after the midterm elections, and he plans to introduce a Tax-Extenders bill next week, which includes the PTC.

After its strongest year ever in 2012 with 13.2 gigawatts (GW) installed, the US wind industry struggled through 2013 after the PTC expired – with a mere 2.8 GW of projects.

"Efforts to renew these incentives are being blocked by Republicans in Congress," says Reid. "Letting these critical incentives expire is not an option. Tax incentives level the playing field for energy, they help make renewables more affordable for consumers and more attractive to investors."

But that goes against fossil fuel interests, who say the exact opposite: The wind tax credit "restricts access to affordable energy" and "hides the true cost of wind power."

Conservatives line up against the PTC

Using the headline, Nationwide Coalition Urges Congress to End Wind Welfare, 66 organizations sent a letter to Republican leaders of both houses, making it clear the PTC should not be renewed. It is signed by groups like Koch-backed Americans for Prosperity, Club for Growth, Heritage Action for America and Competitive Enterprise Institute.

Here’s an excerpt:

"The PTC is a key part of President Obama and Majority Leader Reid’s attack on affordable energy from natural gas, coal, and nuclear."

"Rejecting efforts to extend the PTC is a meaningful way for this Congress to oppose the President’s climate plan.

"Extending the PTC restricts Americans’ access to affordable and reliable energy. The PTC harms Americans in two important ways: it hides the true cost of wind power and encourages states to keep expensive wind power mandates. This makes it easier for the President to promote his restrictions on carbon dioxide emissions from existing power plants because the PTC hides the true costs from ratepayers.

The PTC enables wind operators to use the tax code to engage in predatory pricing against reliable and affordable nuclear, coal, and natural gas power plants. The PTC is such a large subsidy that industrial wind facilities can actually pay the electrical grid to take their electricity and still make money. This predatory pricing is designed to drive nuclear, coal, and natural gas generators out of business and it is only profitable because of the PTC."

PTC Extension

Harry Reid wants the PTC renewed retroactively and is proposing a 2-year extension.

As many of you know, the PTC has been on-again, off-again, providing an uncertain climate for growth of the wind industry.

As part of the "fiscal cliff" deal, the PTC was renewed for 2013, and now the industry is struggling to get it through yet again.

Luckily, in the last go-round, the rules were changed so that projects just had to be started – not finished – by the end of 2013, opening a bigger window for new projects. Recently, the IRS helped by giving some more room for the industry to qualify for the credit.

Without the PTC, the US Energy Information Administration expects growth will slow significantly again after 2016, when current projects are finished.

And that’s exactly what fossil fuel interests want!

Thanks to the wind PTC, the US is one of the largest, fastest growing wind markets, employing some 80,000 Americans in businesses that manufacture 70% of components in the US.

Prices for wind energy have dropped substantially and are the same or even lower than fossil fuels now in most cases!

It’s laughable that fossil fuel advocates call the PTC "welfare," even as they continue fighting to keep their century-long tax credits. Because the US doesn’t have an energy policy, the tax code has been used to spur growth in all kinds of energy, but most estravagantly, oil, coal, gas and nuclear … not wind and other renewables.

In the same fiscal cliff deal that renewed the PTC, fossil fuel industries retained their tax advantages, amounting to $46 billion over the next 10 years. The wind PTC would cost $18 billion if it remained in place during that time.

Wind now supplies 5% of our electricity with 61 GW installed, expected to 9% by 2020. It provides almost 30% of Iowa‘s electricity and South Dakota is close behind.

To level the playing field with conventional energy, Obama’s Science Advisors recommend broadening the PTC to include all forms of renewable energy and keeping it place for 5-10 years.

Chokecherry is an Example

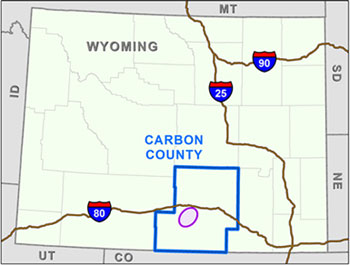

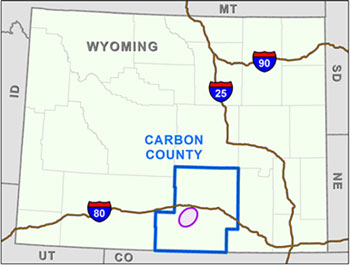

As an example of the kinds of projects the PTC supports, the largest wind project in the world was recently approved for Wyoming – the 3 gigawatt Chokecherry/ Sierra Madre wind project, where 1000 turbines will be spread across 220,000 acres of land.

Sited in one of windiest places in the US, the $5 billion project will supply electricity to 1 million homes – creating 1000 jobs during construction. It is one of the projects President Obama expedited as part of his "We Can’t Wait" (for Congress) initiative.

Because of the size of the project and the strong wind resources, the project is viable without the PTC, but with it, electricity will be cheaper for utilities and their customers, says the developer. That’s an exception to the rule, he says, most projects still need the tax credit to be viable.

Here’s the full letter:

Maine is the only state with the disgusting “Expedited Wind Energy Act,” which needs to be repealed ASAP.

73 percent of Americans, including wide majorities of Republicans, Democrats and Independents support keeping the renewable energy Production Tax Credit, the key federal policy support mechanism for wind energy. -Shauna Theel, American Wind Energy Association.

Read why: http://www.aweablog.org/blog/post/new-poll-finds-73-percent-of-voters-support-crucial-tax-policy-for-wind