By Stephen Lacey, Climate Progress

(This essay was originally posted on Climate Progress)

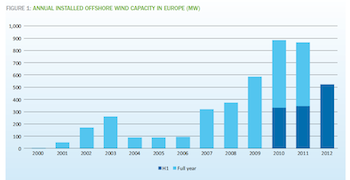

Battling severe economic headwinds, Europe’s wind

industry has picked up the pace and substantially increased offshore projects

developed in the region.

According to the European Wind Energy Association (EWEA),

developers connected 132 turbines to the grid in the first half of this year.

Those turbines, which have the cumulative capacity to generate 523 megawatts (MWs),

represent a 50% increase over the first half of 2011.

As EWEA points out, 2012 has turned into a

surprisingly good year for offshore wind in Europe:

"2012 could turn out to be the best year ever for

offshore wind energy in Europe, as a further 160 turbines, totaling 647.4 MW,

are built but awaiting grid connection. But this is subject to weather

conditions at sea and grid connection delays.

A total of 4,336 MWs offshore wind capacity was operating

as of June 30, 2012 — up from 3,294 MW in June 2011 — producing electricity for

the equivalent of 4 million households.

During the first half of 2012 overall, 13 wind farms were

under construction. Once completed, these wind farms will account for an

additional capacity of 3,762 MW."

(Chart courtesy of EWEA)

In the first six months of this year, the number of financial

transactions closed equaled the number closed in all of 2011. As

we pointed out last fall, no projects in 2011 had been financed through

debt; however, 30% of projects closed this year were done so with debt.

EWEA attributes the increase in deals to the diversity of commercial banks and

public financing agencies engaged in the market.

However, the Danish wind consultancy MAKE

Consulting estimates that project financing will need to grow by 50% over the next five years in order for European countries like Britain,

Germany, and France to meet their offshore wind targets. With European banks

continuing to develerage themselves, it’s not clear if the necessary project

finance will be available.

Bloomberg News also reported on a

report from MAKE on the slump in sales of offshore turbines that will impact

the future pipeline of projects:

"Sales of offshore wind turbines collapsed in the first

half, a sign the power industry and its financiers are struggling to meet the

ambitions of leaders from [Chancellor] Angela Merkel in Germany to Britain’s [Prime Minister] David Cameron.

One unconditional order was made, for 216 MWs, 75% less than in the same period of 2011 and the worst start for a year

since at least 2009, according to preliminary data from MAKE Consulting, a

Danish wind-energy adviser. Vestas Wind Systems A/S (VWS) of Denmark, the

largest manufacturer, won the contract while Germany’s Siemens AG (SIE) was

among those shut out.

In Germany’s section of the North Sea, utility RWE AG

(RWE) is working on foundations for its $1.2 billion Nordsee Ost development

but can’t install turbines until a grid connection is made. Competitor EON AG

(EOAN) said in February its Amrumbank West project will be delayed 15 months

because of grid issues.

The financial crisis has helped draw out negotiations on

funding. Centrica Plc (CNA), Dong Energy A/S and Siemens in June completed a

$660 million financing for the Lincs wind farm off the UK’s shores two years

after talks first started."

The cost of financing and connecting projects to the grid

has raised the installed cost of offshore projects by 30% in the first

half of this year, according to Bloomberg New Energy Finance. Analysts at the

firm say they expect those costs to fall as installation techniques become more

standardized and financing bottlenecks open up. In June, the UK’s Crown Estate

issued a report concluding that the cost of offshore wind projects could

fall by one-third by 2020.

Despite the mixed picture, the industry is taking

a decidedly optimistic view about growth.

The industry’s trade group

projects that the European offshore wind market will grow from roughly 4

gigawatts (GWs) of cumulative capacity to 150 GWs of cumulative capacity by

2030 — meeting about 14% of European electricity demand.

Editor’s Note: Last year, wind accounted for approximately 7% the EU’s energy supply, according to year-end figures from the Global Wind Energy Council.

++++

STEPHEN LACEY is a reporter/blogger for Climate

Progress, where he writes on clean energy policy, technologies, and

finance.

For the complete EWEA outlook on European wind projects:

Loading...

Loading...