| This article is reprinted from the June issue of our green investing newsletter, Progressive Investor. To learn about which green stocks to invest in, and to read the rest of the issue, subscribe or just purchase this issue. |

After a strong 2009, the problems associated with the recession and lack of a US energy policy caught up with the wind industry this year.

Wind supplied 2% of the world’s electricity in 2009. Even during the dog days of the recession, installations charged ahead 31%, ending the year with a breathtaking 38,343 MW in new capacity for a cumulative world total of 158,505 MW. It was the highest growth rate in the last eight years.

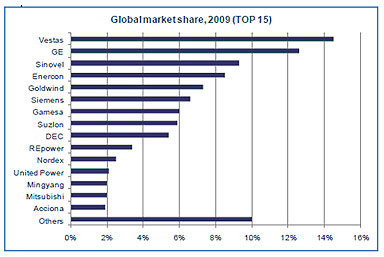

Also of note, China surpassed the US as the largest wind turbine market, installing 13,803 MW, and reaching a total of 25,805 MW. China accounted for over a third of the world’s wind installations in 2009, more than doubling its cumulative capacity for the fourth consecutive year. The US also had a record-breaking year, installing over 10,000 MW.

China introduced a feed-in tariff for new onshore wind plants, but because of inadequate transmission capacity about 25% of its existing wind capacity has yet to be connected to the grid.

To remedy this lack of oversight, China’s National Energy Board announced in late April that 11 provinces must dovetail renewable energy installation schedules – which are mostly wind – with related transmission infrastructure development. The schedules will be used to set targets through 2015 and to choose which projects are eligible for national subsidies.

India became the fifth largest wind producer in 2009. India and China now serve 29% of the world market, with 4 of the top 10 turbine manufacturers.

Not So Good in 2010

As 2009 progressed, however, it became clear the wind industry was living off orders from the previous year and that headwinds were in store for 2010.

Poor project financing conditions in 2009 meant few orders this year. A meager 539 MW was installed in the US during the first quarter of 2010, the lowest levels since early 2007.

In addition, the American Wind Energy Association (AWEA) attributes the slow-down to low energy demand, low natural gas prices and a lack of long-term market signals. On top of that, there’s increased competition, over-loaded inventories and pressure to reduce prices. IHS Emerging Energy Research expects the U.S. wind industry to add only 6300 -7100 MW in 2010.

"2010 marks the first time since 2004 that the U.S. wind industry will not surpass the previous year’s growth level. Despite unprecedented federal wind incentives, reverberations from the financial crisis continue to create a difficult near-term market landscape especially in light of continued energy policy uncertainty," IHS Senior Analyst Matthew Kaplan said.

In a 2010 U.S. Wind Industry Monitor opinion poll (conducted by Droege & Comp), wind executives say lack of financing (72%), lack of national energy policy (67%) and lack of transmission (54%) are "important" or "very important" obstacles to industry growth.

Heightened transmission congestion and waning utility demand for wind are straining growth in traditional wind hot spots including Texas, Minnesota and California, forcing developers to go to states with less prolific resources and more arduous development conditions. Low energy prices have led to waning interest among utilities, making power purchase agreements difficult to get signed.

A national renewable energy standard or federal energy policy legislation and streamlined transmission siting are essential for the U.S. wind market going forward.

On the supply front, the sudden drop in turbine demand and increased competition has created a buyer’s market. Thus, turbine manufacturers are focused on lowering costs through technological innovation, such as Siemens’ next-generation turbine design with direct drive technology and Vestas’ new models which capture lower wind speeds.

In anticipation of better days ahead, nuclear giant Alstom (ALO.PA), Mitsubishi Heavy (7011.T), and A-Power Energy (Nasdaq: APWR) are building manufacturing plants in the US.

Longer Term Prospects Still Bright

Despite these near term challenges, most wind executives believe U.S. business will grow in 2010 (69.6%), 2011 (83%) and 2012 (84.6%).

The Global Wind Energy Coalition (GWEC) expects the North American market to grow steadily for the next two years and then accelerate again in 2012. GWEC forecasts that 63 GW of capacity will be added in the US and Canada over the next five years, an average of 12,600 MW per year. Globally, they anticipate average annual growth of 21%, resulting in global wind capacity increasing from 158.5 GW in 2009 to 409 GW by 2014.

Since much of China’s capacity will be supplied by domestic manufacturers, European producers such as Vestas and Gamesa may capture only 15-20% of the market. In 2009, Vestas’ revenues from the Asia region dropped 20%.

General Electric, the world’s second-biggest turbine maker, expects global sales for land-based wind turbines to grow by $130 billion in the next two years. Rapidly growing markets include: Canada (40% compound annual growth); Latin America (70%); Eastern Europe (28%); China and India by 20%. Offshore turbines are expected to increase by about $100 billion during the next 10 years.

Lastly, utility Sempra Energy (SRE) is doing its part to sustain the North American wind industry. The company plans to build a massive, $5.5 billion wind farm in Baja California, with about 1200 MW in capacity. And Google (GOOG) is investing $38.8 million in two North Dakota wind farms, its first direct investment in utility scale renewable energy.

Companies that continue to do well this year include project developers Iberdrola Renovables (IBR.MC) and PNE Wind (PNE3.DE), which benefit from low turbine prices and stable electric rates. Turbine manufacturer Repower Systems (RPW.DE), unlike peers such as Vestas and Gamesa, has seen orders grow and announced its first dividend. American Superconductor (AMSC) is benefiting from its strong relationship with China’s Sinovel, now the world’s third largest turbine manufacturer.

Sinovel has it sights set on becoming the world’s largest turbine manufacturer within the next five years, and is planning an IPO on the Shanghai Stock Exchange this year. Another Chinese manufacturer has similar aspirations – China Longyuan Power Group Corp (0916.HK) says it will spend $13 billion in the next five years to elevate it to world’s top position. In December 2009, it raised the equivalent of $2.2 billion on the Hong Kong exchange in one of the largest cleantech IPO’s in history.

++++

To learn more about wind stocks, subscribe to our green investing newsletter, Progressive Investor.

Loading...

Loading...