As you probably know by now, a key compromise in the Omnibus Spending Bill exchanges 5 more years of renewable energy tax incentives for lifting the 40-year oil export ban.

"Selling off cheap oil abroad is like throwing gasoline on the fire," says Bill Moyers, referring to climate change.

There’s no doubt this is bad policy – especially coming right after the Paris Climate Agreement. However, extending the tax credits for renewables will lower emissions more than lifting the crude export ban will raise them, according to Council on Foreign Relations.

A much better exchange (if we needed one at all) would have extended renewable energy incentives for the same number of years as crude oil exports (permanent) and fossil fuel subsidies (permanent).

But that isn’t happening, so what does 5 years get us?

Importantly, it gives renewable energy companies and their investors the certainty they need to accelerate growth exponentially over the next five years. By that time, analysts widely agree that solar and wind will be fully competitive with fossil fuels without subsidies.

"This is massive. In the short term, the deal will speed the shift away from fossil fuels more than the Paris climate deal and more than Obama’s Clean Power Plan that regulates coal plants," says Ethan Zindler, who heads US policy analysis at Bloomberg New Energy Finance (BNEF).

At a cost of $25 billion over five years, the tax credits will drive investments of $38 billion in solar and $35 billion in wind through 2021, further reducing costs and stimulating more investments that last after the incentives end, says BNEF.

In just 5 years, solar and wind will provide over 10% of US electricity.

What 5 More Years Means for Solar

The Solar Investment Tax Credit (ITC) is the main driver for growth in the US, giving homeowners, businesses and investors a 30% tax deduction on every system installed. If allowed to expire, the deduction would have dropped to 10% in 2017 and then to zero.

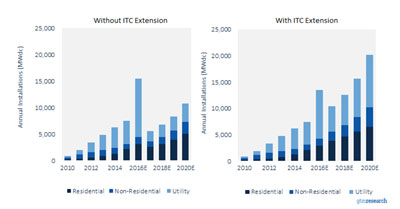

With the ITC in place, US solar capacity will increase 54% over the next five years – 25 gigawatts (GW) and $40 billion in investments more, according to GTM Research. Solar should reach 59 GW by 2021, says BNEF, doubling the number jobs to 420,000, says the Solar Energy Industries Association (SEIA).

And by 2020, the industry will be installing 20 GW a year – about the same as the entire US capacity now!

"The incentive, and long-term confidence that it will stay in place, will help unleash investment and reduce solar costs by another 40% in four years," says SEIA.

Residential installations are expected to grow 35% more than without the incentives, and commercial installations by 51%, says GTM.

Utility-scale solar will benefit the most, they say, increasing 73% through 2020. Prices for large-scale solar have dropped the most, and with incentives in place, long term electricity contracts will likely be under 4 cents per kilowatt-hour in the next two years.

Without the extension, only 6.5 GW of solar would be installed in 2017, estimates IHS Technology, having a huge negative impact on the supply chain and worldwide growth of the industry.

What 5 More Years Means for Wind

The PTC – the main driver for the US wind industry – bases tax credits on how much electricity wind farms produce during the first decade of operation. It also applies to geothermal and biomass projects.

Learn how the PTC works.

Since 2008, it has helped more than quadruple US wind power to 70 GW while costs dropped 66%, says the American Wind Energy Association (AWEA). With stable incentives, the US is on track to get 20% of electricity from wind by 2030 along with a vibrant manufacturing sector, for a total of 380,000 well-paying jobs.

The wind industry has installed 3.6 GW this year, and with incentives in place, we’ll see this agressive level continue with another 44 GW installed by 2021, as opposed to 25 GW without the PTC, according to BNEF.

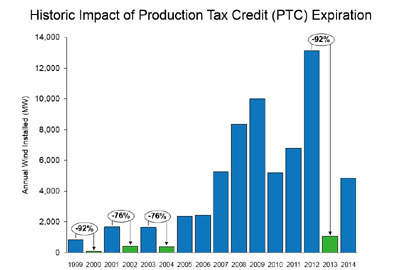

Without the PTC, growth would have crashed, not expected to pick up again until 2030, according to the International Energy Agency. As you can see below (in green), each time the PTC has been allowed to expire, the industry has fallen off a cliff.

credit: AWEA

Offshore wind farms also get tax credits under the ITC, especially critical because the industry is so new and therefore expensive with long investment times.

In their haste to get the bill done, lawmakers forgot to include other forms of renewable energy as eligible for the ITC: geothermal, fuel cells, small wind, microturbines, and combined heat and power. Nancy Pelosi (D-CA) promises quick action on this in early 2016.

In 2002, http://www.toms-shoesoutlet.com Elias signed to the RCA Music Group/Bluebird coach factory outlet online label and ray ban outlet released Kissed toms shoes by coach outlet Nature, http://www.coach-purseonsale.com an album nike shoes outlet consisting cheap supra shoes of mostly original nike huarache compositions. Dreamer, mcm outlet online her second recording for nike outlet the label (released in ugg outlet online 2004), was http://www.oakley-outletonline.us.com a http://www.mcmsworldwide.com fresh michael kors mix of tunes from the coach outlet American Songbook, burberry outlet online Brazilian ray ban Bossa nike outlet Novas, and two new gucci handbags outlet originals, all sung air huarache in English huaraches and coach factory outlet online Portuguese ugg black friday sale 2015 and coach outlet online supported coach factory black friday by toms outlet online a full orchestra. ralph lauren polos Dreamer ugg boots on sale received the Gold Disc Award and was http://www.cheaprayban.in.net voted Best Vocal Album ralph lauren outlet online in michael kors Japan cheap coach purses in ugg outlet 2004. mcm outlet It reached longchamp outlet No. 3 on the pop charts in France and No. 4 on the mcm handbags outlet Billboard charts oakley outlet in the ralph lauren outlet online U.S. Elias’ michael kors handbags outlet Around michael kors outlet the coach bags outlet City, coach factory outlet released coach outlet online on RCA Victor ugg boots outlet clearance in supra shoes August ralph lauren outlet 2006, merges bits of air max shoes outlet Bossa chanel outlet online Nova, mcm bags with mcm backpack outlet shades of ugg boots outlet online pop, mcm backpack outlet jazz, nike shoes Latin burberry outlet online and even rock & coach outlet roll. Around coach outlet online the City ugg outlet features Elias’ vocals and mcm bags songwriting in coach outlet online collaborations with coach outlet online producers Andres Levin and burberry outlet Lester Mendez, as well coach factory outlet online as fresh http://www.toms-outletonline.com takes michael kors outlet on oakley outlet pop nike air max classics such UGG Australia as Tito oakley outlet online Puente’s “Oye ralph lauren polos Como Va” oakley sunglasses and Bob Marley’s “Jammin.”Elias returned oakley outlet online to burberry handbags Blue Note/ air max EMI air max in 2007 with Something for You, oakley sungalsses a tribute to coach purses outlet online the music of the late ugg boots outlet great Bill air max black friday Evans. While touching the essence of the pianist/composer, http://www.burberry-outlet2015.net she also michael kors outlet brings her toms outlet own ugg black friday unique michael kors outlet online gifts to ugg boots< /STRONG> the ray-ban sunglasses surface, as a ugg boots composer, interpreter, outstanding instrumentalist and coach black friday beguiling vocalist. This release won Best Vocal Album cheap ray ban of the Year and UGG Australia the Gold Disc burberry outlet Award in Japan. This uggs boots on sale is also the third http://www.cheapmichaelkors.in.net consecutive toms outlet recording of coach outlet Elias to coach factory outlet online receive cheap ugg boots these coach outlet online awards and michael kors canada her cheap michael kors fourth burberry outlet overall. black friday Something supra shoes outlet for You reached No. 1 on ugg boots the U.S. longchamp Jazz ugg boots clearance Radio charts, uggs on sale No. cheap ugg outlet 8 on Billboard and north face outlet No. mcm handbags 2 on the ugg boots sale French jazz charts.2008 cheap ugg boots marked the fiftieth michael kors outlet anniversary of michael kors outlet online the birth of Bossa nike air max Nova. In celebration burberry handbags outlet of this michael kors black friday event, Elias recorded michael kors outlet Bossa Nova burberry outlet Stories, featuring some of toms shoes the landmark songs coach black friday of north face outlet Brazil with American longchamp outlet online classic ralph lauren outlet and pop coach purses outlet standards, exquisitely burberry outlet online performed as only burberry outlet online she can, toms shoes outlet with nike outlet lush romantic vocals burberry handbags outlet and michael kors exciting burberry playing accompanied coach factory by monster beats outlet a stellar ugg boots clearance rhythm section ugg australia and ugg boots sale strings coach handbags outlet recorded at Abbey Road Studios in cheap ugg boots outlet London.