As they do preceding each UN Climate Summit, many of the world’s largest institutional investors sent a letter calling on world leaders to aggressively act on climate change.

340 global investment managers issued the statement, representing $24 trillion in assets – up from $13 trillion in 2009 before the Copenhagen summit. Signatories include BlackRock, Calvert Investments, BNP Paribas Investment Partners, Standard Bank, CalPERS, PensionDanmark and Deutsche Bank.

In the past, they called for a strong international treaty and outlined what it should include. This time, they are calling for a "stable, reliable, economically meaningful" price on carbon – either through a tax or cap-and-trade – that "helps redirect investment commensurate with the

scale of the climate change challenge." They also called for fossil fuel subsidies to be phased out.

"Stronger political leadership and more ambitious policies are needed in order for us to scale up our investments." Gaps and delays in moving forward on such policies increase investment risks because the physical impacts of climate change "will increase the likelihood that more radical policy measures will be required to reduce greenhouse gas emissions."

And investments are critical, they say, pointing to the minimum of $1 trillion a year (by 2050) that’s necessary to limit temperature rise to 2 degrees C, according to the International Energy Agency. Currently, just $254 billion is being invested.

Currently, the world is headed to 6 degrees C, says IEA. Taking into account countries’ stated targets for efficiency and renewables, the world is headed for a 4 degrees C scenario.

"The perception prevails that we need to choose between economic well-being

or climate stability. The truth is that we need both. What is needed is an

unprecedented re-channeling of investment from today’s economy into the

low-carbon economy of tomorrow," they say.

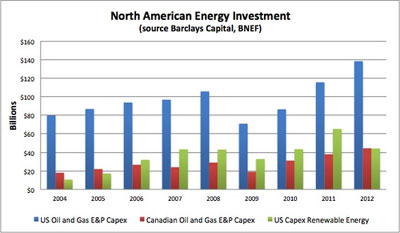

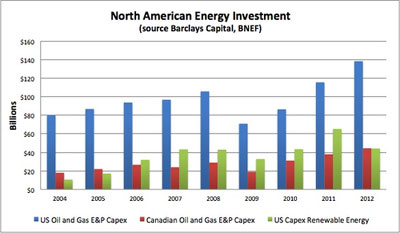

Investments in fossil fuels vs renewable energy:

In an accompanying report, they outlined investments they have been making to further the transition, such as making direct investments in low carbon technologies, creating funds that invest in those companies, engaging with public corporations via shareholder resolutions, and reducing exposure to fossil fuel and carbon

intensive companies.

-

Danish pension fund PKA is ramping investments in

wind farms to $1.5 billion by the end of 2015. - Swedish pension fund AP4 is decarbonizing its entire $20

billion portfolio of publicly traded companies. - ASN Bank in the Netherlands to become fully carbon-neutral by 2030.

- TIAA-CREFF cut the carbon footprint of its real estate portfolio 17%.

- Zurich Insurance Group is investing in up to $2 billion in green bonds.

- Global bank ING has reduced its energy allocation on loans from 63% to 13% for coal plants, while raising the allocation for renewable energy from 5% to 39%.

They also launched an online database that includes many of their investments, the Low Carbon Investment Registry. It will give the public and

policymakers a better understanding of how private capital is currently flowing into low carbon investments.

The United Nations Environment Program’s Finance Initiative (UNEP FI) worked with four investor groups to coordinate these actions: Ceres’ Investor Network on Climate Risk; European Institutional Investors Group on Climate Change; Investors Group on Climate Change in Australia and New

Zealand; and Asia Investor Group on Climate Change.

Here’s the Low Carbon Investment Registry: