When corporations pollute, shouldn’t they pay to clean it up?

That used to be the case, but amazingly, EPA’s Superfund tax expired in 1995 and has yet to be renewed. Since then, the trust fund has run out of money and guess who is footing the bill? Taxpayers, of course.

It’s just one more way we subsidize corporate America, which complains about paying high taxes. EPA doesn’t have the authority to make corporations responsible for clean-up of toxic industrial sites. Indeed, BP’s Gulf oil spill caused one mess of a Superfund site and they took tax deductions for the money they spent for cleanup!

Introducing the Superfund Polluter Pays Restoration Act of 2014, which would re-instate the tax, Senator Cory Booker (D-NJ) says, "Every day, innocent New Jerseyans suffer the physical and financial consequences of living close to severely contaminated sites. This legislation holds industries accountable for cleaning up the harmful results of their irresponsible practices. Taxpayers shouldn’t finance cleanup of a mess they didn’t create. This bill corrects an inexcusable injustice and places the onus on polluters to restore Superfund sites back to safe, healthy areas that can attract investment and economic development."

Senator Bob Menendez (D-NJ) and Barbara Boxer (D-CA) are co-sponsors of the bill.

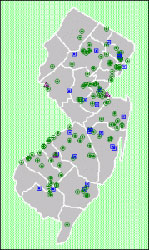

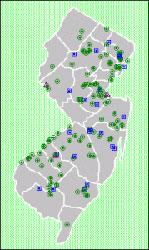

New Jersey has 114 Superfund sites on EPA’s priority list, more than any other state, says Booker – over 1300 sites across the US are waiting for action.

"The Superfund can’t accomplish its mission without a consistent funding mechanism like the excise tax. Appropriated budgets in 2013 and 2014 were the lowest in 25 years. The result, as you well know, is a tortuous pace for completing clean-ups, if they are started at all," says Doug O’Malley, Executive Director, Environment New Jersey.

Corporations say they are unfairly targeted because the fund is used for all kinds of cleanups, not just theirs. Only

polluting industries are taxed – oil and oil refineries, and those that use or make hazardous chemicals.

Mining waste, lead smelters and landfills are prime sources of Superfund sites, contaminating ground water, soil, air and sediment. Asbestos, lead, mercury, arsenic and benzene are among chemicals commonly found.

Booker’s bill expands the definition of crude oil to include tar sands and shale, and makes funds available to EPA ongoing, rather than subject to annual appropriations.

Try getting this bill through the House!

EPA’s RE-Powering America’s Land Initiative, launched in 2008, identifies contaminated land, landfills and mine sites that would be appropriate for renewable energy. More than 10,000 sites are appropriate for solar, for example, and could cumulatively support 30 times the amount currently installed in the US. Over 70 renewable energy projects have so far been built on these lands, including the first solar farm on an active Superfund site, a Brooklyn Whole Foods supermarket, and a Connecticut biomass plant.

An online Renewable Energy Siting Tool developed by EPA and NREL shows aerial perspectives and data for roughly 11,000 sites in California alone, highlighting 75 priority sites. Another tool locates sites across the country.

Find out where Superfund sites are near you:

You can’t be serious. When corporations who actually contribute to Superfund sites are identified, they do pay for the cleanup. If the company no longer exists, the entity that bought them pays for the cleanup. What you are advocating is that current companies, simply because they create waste (that they are almost certainly paying to dispose of legally) be charged for problems that they did not create. How is that more fair than charging taxpayers who didn’t create the problems?

“Black on Green” raises an interesting ethical delimma. Let’s say an oil company is founded, makes a lot of money, then gets caught creating an environmental mess. The company declares bankruptcy. Who then pays to clean up the mess? Since by definition a corporation’s owners have no liability the burden of cleanup falls on the taxpayers. In one regard you could say that the taxpayers benefited from the oil so they do have some liability. On the other hand you could say that existing oil companies are likely to cause the same problems so they should pay a tax in anticipation of future damage. Certainly getting a tax deduction for expenses related to damage you caused seems counter productive.

Black on Green: if corporations clean up their mess then why is the public saddled with cleaning up 1300 toxic sites across the US?

Stop pollution. Take care usa and the all planet