On the one-year anniversary of California’s carbon market, the results are in – it is a success.

The program has raised an impressive $1.4 billion for California. Half of that funds renewable energy projects and cutting emissions, including $130 million specifically destined for low-income communities.

As complex as it is to start a cap-and-trade program, all five carbon auctions have run smoothly with strong sales, daily trade volumes are healthy, and prices are stable and reasonable.

The past two auctions have sold out. At this month’s auction, $297 million worth of allowances were sold at $11.48 each (over 16 million allowances sold), giving polluters the right to emit 1 metric ton of carbon next year.

Almost 2 bids were received for every available allowance, indicated strong demand, and 9.6 million of permits sold can’t be used until 2016, demonstrating the long-term viability of the program.

While some criticize the relatively low prices paid for carbon allowances as a sign of a weak market, it actually shows "the increased understanding that compliance will be less costly than previously expected," says Katie Hsia-Kiung from Environment Defense Fund. The current floor price of $10.71 will rise each year (to $11.34 in 2014) providing a strong price signal for increasing clean energy, she says.

Although the Northeast cap-and-trade exchange (RGGI) is also considered extremely successful, the regional program sells allowances for much less – about $3 – and raised $125 million in its most successful quarterly auction. Since 2008, there have been 22 auctions, raising a total of $1.5 billion for efficiency and renewable energy projects in the region.

The way has been cleared for Quebec to join with California’s program on January 1, 2014, establishing the first international carbon market in North America. Quebec is expected to raise at least $2.5 billion by 2020 because of the linkage. In Quebec’s first auction, held last week, it raised $29 million, which met government expectations.

California companies paid about $297 million to release carbon emissions at the state’s most recent cap-and-trade auction, according to data published in late November.

The state’s fifth auction on Nov. 19 sold all 16.6 carbon allowances, with firms including Exxon Mobil and Dow Chemical paying $11.48 per allowance to release 1 metric ton of carbon as early as this year.

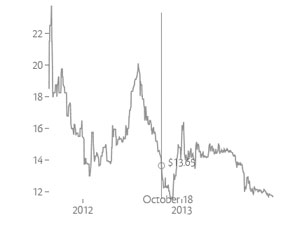

A new California Carbon Dashboard makes it easy track carbon prices (graph below), sector emissions levels and relevant news.

Research shows that carbon taxes and cap-and-trade systems are the most cost-efficient, effective ways to quickly reduce carbon emissions.

China Moves Ahead

Meanwhile, China, which is in the midst of rolling out pilot cap-and-trade markets in its biggest cities, launched programs in Beijing and Shanghai.

In June, Shenzhen became the first city to participate; four more cities come online this year and next.

Each city has somewhat different requirements as the country experiments with what will work best – preparing for an official country-wide launch in 2015.

In Shanghai, the government set annual carbon emissions quotas for participating companies for 2013-2015. If they can’t be met, companies must buy allowances or face fines and the loss of government subsidies.

Learn about how each exchange works: