If you watched the two superb episodes on ALEC that Bill Moyers did on PBS, you know this organization works diligently and relentlessly and has a long term view.

This year, rolling back or eliminating state Renewable Portfolio Standards made it onto their priority list along with voter suppression and many other issues. The American Tradition Institute also has an on-going lawsuit that argues RPSs are unconstitutional.

The good news is that although there was lots of activity – over 120 bills introduced across the country – the net effect is that states chose to strengthen or modify their RPS, not eliminate them in even one state.

The bad news is ALEC won’t give up.

Now that this legislative session has ended, the Center for the New Energy Economy at Colorado State University has summarized the results.

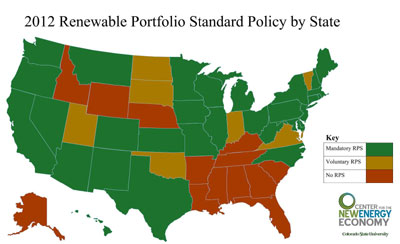

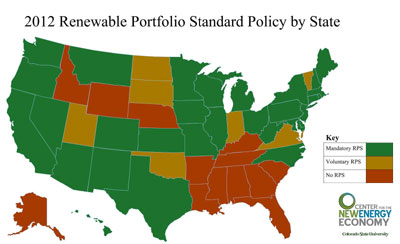

30 states have mandatory RPSs and 7 have voluntary ones, requiring utilities to source a percentage of their energy from renewables by a target date, which varies state to state.

Three states – Colorado, Minnesota and Nevada – strengthened their RPS, making the market for renewables in the US larger overall.

Out of the 121 bills introduced in the states, 29 proposed strengthening the RPS, 26 proposed rolling it back and 66 proposed modifications. Only eight states enacted any changes and those were to either increase or a modify the RPS, some of which lay the groundwork for ALEC, like Connecticut.

This year, the strategy for rollbacks seems to be following a new trend. Instead of trying to cap the RPS in terms of cost, the focus shifted to including big hydro and other non-renewable sources in the RPS in order to dilute it.

Rollbacks failed this year in Kansas, Missouri, Ohio, North Carolina, Texas, West Virginia and Wisconsin.

8 States Enact Legislation

Minnesota: despite the introduction of ALEC-inspired bills to repeal the RPS, HF956 strengthens it. Its 25% renewables by 2025 RPS now includes a 1.5% solar carve-out, 10% of which must be met through distributed generation.

Colorado: SB 252 increases the RPS for cooperatives to 25% by 2020. It also allows coal-mine methane and synthetic gas produced by pyrolysis of municipal waste as eligible for the RPS if they are determined to be greenhouse-gas neutral.

Nevada: SB 252 removes provisions that allow energy efficiency measures to count towards compliance, revises the solar multiplier and establishes a 10% cap on carryover credits.

Connecticut: SB 1138 increases the size limit on eligible small hydro from 5 MW to 30 MW, and includes large hydro as eligible. The RPS is modified so that 25% of renewables must be from "class 1" resources (solar, wind, small hydro) by 2020, up from 20%, and up to 7.5% of that can be met by Class IA resources, such a big hydro.

"Connecticut has thrown up the white flag on its ambitious renewable targets, and is now negotiating its terms

of surrender," says Nick Culver of Bloomberg New

Energy Finance. "Instead of simply easing back targets, they intend to widen eligibility criteria to include imported hydropower from Canada that would have been built regardless, which amounts to pretty much the same thing."

Maryland: HB 1084 establishes a taskforce to evaluate how to include thermal energy into the RPS; HB 1534 alters the definition of "solar water heating system" to include certain concentrating solar thermal collectors; HB 226 creates a carve-out (2.5% by 2017) for offshore wind. SB 976 failed, which would have extended eligibility to coal-fired generation plants that convert to natural gas.

Montana: SB 106 adds compressed air energy generated from eligible resources and SB 45 adds hydroelectric project expansions. SB52 modifies reporting requirements and SB164 exempts small utilities (50 customers or less) from complying with the RPS.

Virginia: HB 1917 includes solar thermal in the RPS; HB 2180 requires that electricity be generated, not simply purchased, to comply; HB 2261 repeals an increased rate of return for utilities that meet the RPS, but it holds for certain wind and nuclear generation instances.

Washington: SB 5400 allows utilities that serve multiple states to comply by using renewables outside of Washington; SB 5297 allows utilities without load growth to purchase coal as transition power while they continue meeting the reduced cost cap for renewable energy investments.

Roll-Back Proposals that Failed

Kansas: Bills to rollback the 20% by 2020 goal to 15% by 2018, died in committee.

Missouri: a bill to include existing hydro plants as eligible stalled in the Senate.

North Carolina: originally full repeal was proposed; it was modified to end the RPS after achieving 6% renewables by 2015. Stalled.

Ohio: Repeal standard; stalled.

Texas: Repeal standard, stalled in committee.

West Virginia: one bill repealed the RPS, another delayed implementation; died in committee.

Wisconsin: Freeze requirements at current levels; stalled.

At the end of the legislative session there were over 2100 energy-related bills pending in the states, according to the Center’s Advanced Energy Legislation Tracker.

ALEC’s footprint can be found in the new, weaker natural gas fracking regulations proposed by the Department of Interior. It is based on ALEC‘s model bill, which was written by ExxonMobil! And it is pushing states to approve the Keystone tar sands pipeline.

Watch the United States of ALEC on Bill Moyers: