By Ardour Capital

On December 1, the House Select Committee on Energy Independence and Global Warming announced it will no longer exist when the next congressional session begins. The committee, which was established by Democrats in 2007 to study energy and climate issues, held over 50 sessions regarding environmental legislation.

Global Solar Demand in 2011

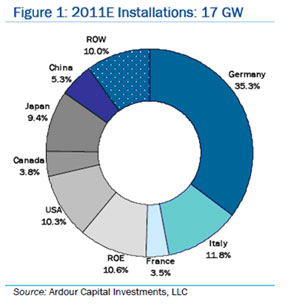

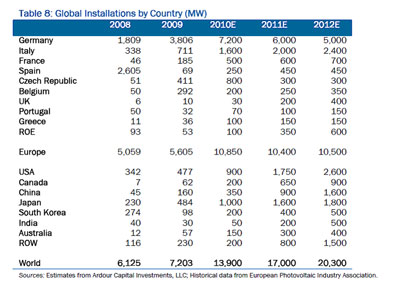

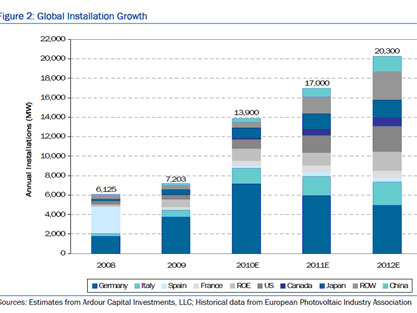

Based on solar installations year-to-date and changes to feed-in tariff (FIT) programs made or announced in the major PV markets, we are raising our estimates for 2010 and 2011. We believe global demand will continue to grow steadily in 2011, but well below the pace of 2010. Germany will still be the main player, but several countries (such as Italy, the US, and Japan) will be gigawatt markets next year.

- We increase our 2011 global installation forecast to 17 GW, and introduce our 2012 estimate of 20.3 GW.

- Europe is on track to double installations in 2010; demand should be flat in 2011.

- The North American market will more than double in 2011.

- Geographic diversification will come from Asia and several new markets.

- Given our 2011 growth projections and compelling valuations, we see attractive entry points for these solar stocks: First Solar (NASDAQ: FSLR), Trina Solar (NYSE: TSL), Power-One (NASDAQ: PWER) and Satcon (NASDAQ: SATC).

We believe the PV market will be up ~22% in 2011 (not nearly the 92% expected in 2010), and estimate 17 GW in global demand.

Volatility will likely be high over the next few months as several European countries revise subsidy programs. We expect demand from Europe to be flattish next year (10,400 MW vs 10,850 MW in 2010), while North America (2,400 MW) and all other markets (4,200 MW) should more than double 2010 estimates (1,100 MW and 1,950 MW, respectively). We believe similar growth will be sustained in 2012, and estimate a total of 20.3 GW to be installed, up ~19% on an annual basis.

Europe is on track to double installations in 2010, and we expect demand to remain flat in 2011. Most key European countries have announced or made cuts to their FIT; however, due to lower prices and demand elasticity, we expect the European market to remain at the same level as in 2010.

Declines in Germany (still the world’s main market) and the Czech Republic (expected to slash both tariffs and size of the installations that can apply for them), will be offset by growing markets, such as Italy (a lucrative market, with plenty of annual sun-hours). Further growth, on a smaller scale, will come from France (which just announced a potential freeze on new projects), UK, Greece, and Bulgaria. Spain decided not to retroactively cut its 2008 tariffs, but a cap of ~500 MW/yr continues to curb this market.

We see the North American market more than doubling in 2011. We estimate the US market will double in 2010 to 900 MW, and expect similar growth in 2011, with 1,750 MW likely to be installed.

We handicap the extension of the cash grant at ~50%, but see a growing group of tax equity investors to support 2011 growth. The Canadian province of Ontario is promoting the solar market with some of the most generous tariffs worldwide; we forecast its market to grow from an estimated 200 MW in 2010 to 650 MW next year.

Geographic diversification will likely come from Asia and several new markets. We expect the PV market in Asia to grow significantly compared to 2010. Japan will continue to grow supported by a FIT. As for China, despite a delay in establishing a national solar FIT program, installations will more than double 2010 estimates because of local pilot programs. China will ramp its domestic market as European growth slows and installed system prices decline.

Other growth will come primarily from India and South Korea, as well as Australia, Africa, and the Middle East.

Germany

Germany’s tariffs are active through the end of 2010. The cut to the 2011 FIT depends on the megawatts installed from June-September 2010. During that time, Germany installed an estimated 3,628 MW, leading to a 13% cut. IRRs ranged in the mid to high single digits, and will likely settle in the mid single digit range after the 2011 cut.

We expect a strong fourth quarter as installers and investors rush to lock in the 2010 tariffs. Since two other cuts this year have already been absorbed by the market, and there will be some tight supply, we believe Q42010 won’t be as strong as Q42009.

We are increasing our full year 2010 estimate for Germany to 7,200 MW. Based on conversations with local contacts and on the fact that potential cuts to the 2012 program could be larger than those in 2011, we are also boosting our 2011 estimate.

For next year, we still see Germany leading the global market, and anticipate 6,000 MW to be installed.

Italy

The current FIT program is active through the end of the year. Developers have until December 31, 2010 to complete installations, and until June 30, 2011 to connect to the grid, allowing sufficient time to deal with complex Italian bureaucracy.

We forecast a strong fourth quarter in Italy, sustained by a mild climate, and raise our 2010 estimate to 1,600 MW.

Starting January 1, 2011, the tariffs will be adjusted every four months. Despite subsidy declines, IRRs remain very attractive in the mid to high teens. In 2012-2013, tariffs will decline 6% a year, but we believe the program will still drive investment.

The cap for traditional PV, for 2011-13, is 3,000 MW and once reached a 14-month grace period begins to allow developers to complete installations. The 2011-13 program also includes special annual rates and separate caps for innovative BIPV and concentrated PV; cuts to these rates will be 2% per year in 2012 and 2013.

We believe part of the solar demand from declining markets will shift to Italy, and our estimate for 2011 is 2,000 MW.

France

Despite September 1 tariff cuts, France still has some of the most attractive programs. IRRs range from 15-20% (depending on sun hours), driving significant investment. However, the news related to a potential temporary freeze on new projects and a new regulatory framework starting March 2011 will affect the market growth.

The French Government seems to favor small, rooftop installations, which would not be affected by the freeze. Hence, we expect a large number of small residential installations. Our estimates are 500 MW in 2010 and 600 MW in 2011.

The tariffs are adjusted annually for inflation, and France has a soft cap of 1,500 sun-hour/yr for which installers will get paid full price; over that limit the electricity generated is only paid €0.05/kWh.

Spain

Spain’s government recently concluded investigations on potential fraud connected to 2008 tariffs, and decided not to make retroactive cuts for existing installations. This decision will help installers regain confidence in the Spanish market, and estimate 250 MW in new installations in 2010.

In 2011, new tariffs and caps will be enforced. Cuts seem to favor small rooftops installations (5% cut) over ground mounted solar parks (45% cut). Considering the amount of sun-hour/yr in Spain and that tariffs are paid for 25 years, the new FIT program can still be considered positive. In 2011, tariffs and caps will be adjusted quarterly, based on demand in the previous quarter; we estimate the Spanish PV market at 450 MW.

Czech Republic

Czech Republic has extremely generous tariffs valid throughout 2010, and we estimate 800 MW will be installed by the end of the year.

However, the government is taking a drastic step back because of concerns for grid instability and the impact of PV subsidies on consumers’ electricity bills. It cut tariffs by up to ~50% for the first two months of 2011, and starting March, only rooftop installations smaller than 30 kW will be subsidized. A final decision, including the actual tariffs paid, will be made soon.

Tariffs will be adjusted annually for inflation, between 2-4%, and installers can opt to receive in lieu of the tariff the retail price of electricity plus a bonus. Given the cuts and uncertainty of the Czech market our estimate for 2011 is 300 MW of new PV installations.

Ontario, Canada

Ontario offers some of the highest PV tariffs in the world. We forecast 200 MW will be installed in 2010, and 650 MW in 2011.

The program, which was amended over the summer, is expected to be revised every two years, and has a limit of 10 MW installed capacity for a single solar park. Ontario is also using the program to support the local solar industry. In fact, in 2010, 40% of domestic goods and services must be used for installations ≤ 10 kW, and 50% for installations larger than 10 kW. In 2011, both limits will be increased to 60%.

Japan claims these requirements disregard the World Trade Organization’s (WTO) rules against discrimination of products made overseas, and formally started a dispute with Canada and requested WTO consultation.

Japan

The Japanese solar market has recently been revitalized by several subsidy programs, after many years of flattish demand.

PV installers can qualify for government subsidies of ¥70,000/kW (~$850/kW) for residential installations up to 10 kW, and receive 33-50% capital expenditures for all other installations. Several tax credits and other local subsidies are also in force. Japan also has a 10-year FIT system that mandates electric companies buy only the excess electricity produced at a price that will be adjusted annually. These tariffs are expected to be valid at least until March 2011. For installations larger than 500 kW, the purchase price is negotiated between solar installers and power companies.

Due to these generous subsidy programs, we believe Japan will be able to install 1,000 MW in 2010, and grow to 1,600 MW next year.

United States

On the federal level, the US solar market is largely driven by the Investment Tax Credit (ITC), which is equal to 30% of capital expenditures for a solar installation. The tax credit doesn’t have a cap and is in place until the end of 2016.

In February 2009, the American Recovery and Reinvestment Act (ARRA) led to the implementation of a 30% cash grant in lieu of the 30% credit for projects that begin construction by the end of 2010. After that, the program reverts to the 30% credit.

The US solar market is further supported by state programs in the form of additional subsidies and renewable portfolio standards. The top 5 US states based on MW installed in 2009 (when 477 MW was installed) were: California (~50%), New Jersey (~13%), Florida (~8%), Colorado (~5%) and Arizona (~5%).

In 2010, we believe Nevada and Arizona will improve their positions in the top five due to several large scale projects completed this year. Our estimates are 900 MW for 2010, and 1,750 MW in 2011.

California

Solar volume growth in California is further supported by the California Solar Initiative, a performance and expected performance-based subsidy program.

The performance-based incentive is for residential and commercial systems ≤ 30 kW. It offers $2.50/watt AC (residential and commercial) and $3.25/watt AC (government entities and non-profits) up-front payments on expected performance based on equipment rating and specific installation factors. The performance-based incentive is for commercial systems > 30 kW. It offers $0.39/kWh for the first 5 years for taxable entities and $0.50/kWh for government entities and non-profits.

New Jersey

Solar volume growth in New Jersey is further supported by a growing Solar Renewable Energy Certificate (SREC) market. One SREC is equivalent to 1 MWh, and can be sold to utilities to meet state renewable portfolio standards (RPS).

As such, SRECs act as a performance-based incentive that sweetens returns for owners and investors in solar projects. The price of the SREC is determined primarily by market availability and price of the Solar Alternative Compliance Payment (SACP). The average price for SRECs in the New Jersey market has ranged from $300 to $700/MWh in the past two years.

Other European Markets

We believe significant capacity will be installed in Belgium, Greece, and potentially UK, Bulgaria, and Portugal. Our estimates for total demand from these markets combined are 500 MW in 2010 and 1,050 MW in 2011.

Other World Markets

A significant PV FIT program capable of boosting China’s local market is still lacking. Presently, local installations are subsidized by the Golden Sun Program and the Solar Roofs Program. However, at the end of 2011, significant new PV module manufacturing capacity is expected to come online, which should exceed demand and pressure prices.

Under this scenario, we believe the Chinese government might intervene and subsidize the local manufacturing industry starting at the end of 2011. Our estimates for PV installations in China are 350 MW in 2010 and 900 MW in 2011.

Several new solar markets are developing around the world, such as India, Thailand, Malaysia, Taiwan, the Middle East, South Africa, and Australia. We believe they will add significant global demand, especially starting in 2011. We also expect South Korea to return to significant solar installations, after a slow 2009. For these countries combined, we estimate total PV installations at 600 MW in 2010, and 1,700 MW in 2011.

++++

Ardour Capital publishes in-depth company research, extensive technology-focused reports and a wide range of financial services for public and private companies in Energy Technology/Alternative Energy & Power/Clean & Renewable Technologies. Ardour Global Indexes is a family of pure-play alternative energy indexes.

Loading...

Loading...