Today is a tough one for the wind industry and the millions of people who support it.

The Renewable Energy Production Tax Credit (PTC) – which also applies to geothermal and biomass – is part of the Tax Extenders bill which passed today in the House and is expected to pass in the Senate next week. After leaving it until the last minute, there’s no time to negotiate a better bill this year.

True to form, the House did as little as possible – retroactively extending tax breaks that expired at the end of 2013 through this year. That does absolutely nothing for the wind industry, which relies on the credits to get new projects started.

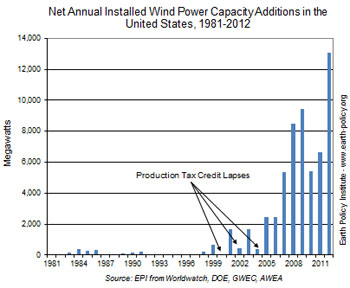

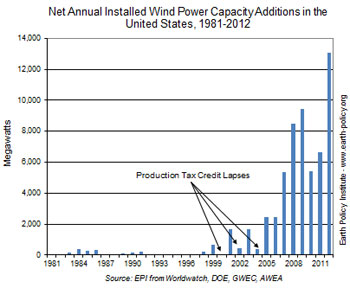

Without renewal, EIA expects growth of the wind industry to slow significantly after 2016 – when current projects are finished. The PTC is a major reason, the US leads the world on wind energy production.

There’s still a bit of hope. House Democrats pushed unsuccessfully for a two-year extension, and Senators Tom Udall (D-NM), Ed Markey (D-MA) and Senate Finance Chairman Ron Wyden (D-OR) will try to get that through in the Senate. Majority Leader Harry Reid (D-NV) says they may not even have time to vote this year in the Senate.

The bill, Tax Increase Prevention Act of 2014 (H.R. 5771), renews some 50 tax breaks that expired in 2013, ranging from business research to the Earned Income Tax Credit and the Child Tax Credit. It includes four key energy efficiency tax credits for energy-saving appliances, homes and commercial buildings; an offshore wind tax credit; and one for purchasing hybrid medium- and heavy-duty trucks. It also includes an $8000 tax credit on hydrogen fueled cars – the first of which come out next year.

Read about those tax credits here, Slew of Important Tax Credits Expire December 31.

"This on-again, off-again style of legislating on a temporary basis is a terrible way to make tax policy. We’re the only nation in the world that lets large pieces of its tax code expire," says Rep. Dave Camp (R-MI).

Members of the House Sustainable Energy and Environment Coalition (SEEC) released this statement:

"One year ago, SEEC Leadership sent a letter to Ways and Means Committee Chairman David Camp urging a permanent or long-term extension of several clean energy tax incentives that were about to expire.

Today’s short-term, mostly retroactive extension of many of these tax provisions is the absolute minimum necessary. Without a longer-term extension, at least through 2015, businesses, workers, and investors will again be forced to deal with the uncertainty that these types of halt-then-hurry policies create.

As soon as many of the extensions contained in H.R. 5771 expire, a new session of Congress will also begin. We hope that Republican Leadership-in acknowledgement of the need to provide certainty to American families and businesses – take up these clean energy incentives in 2015 without delay."

58 Democrats are members of SEEC, which exists to promote policies that arrest climate change and create a thriving renewable energy industry in the US.

Conservatives are lined up against supporting the wind industry with tax credits, and you can be sure they will do the same when the solar tax credit expires in 2016. Investors are already bumping up against that deadline, making the future of utility-scale solar hazy. It reimburses 30% of development costs for solar projects and drops to 10% at the end of 2016.

Next year, many expect a wave of mergers where we could end up with 6-12 solar conglomerates that can compete.

"In the next year, the residential solar market will thin out very quickly. There will be three or four companies going for a national footprint and brand name, and they will have roughly 70-80 percent of the market. You have to be vertically integrated," NRG CEO David Crane told Bloomberg.

This is Not a Joke

At the most basic level, these tax credits are there for a reason. The world is facing catastrophic climate change, and wind and solar are among the most important solutions.

Both industries are booming thanks to policy support. If this support stays in place, they will grow at an even faster pace. Solar can easily provide 10% of US electricity in next decade or so, and wind can reach 30%. And it’s cheap: renewing the wind PTC for two more years costs $13 billion spread over the next decade, according to the Joint Committee on Taxation.

This is not a time to put a break on these industries, it’s time to put our collective feet on the panel/ turbine pedal.

To understand what this means for the wind industry, read our article, Saying Goodbye to the Wind Production Tax Credit.