In June, we were so impressed by former Treasury Secretary Henry Paulson’s NY Times editorial, that we published it in full – Financial Bubble Presages Coming Climate Crash.

For years, we watched on the sidelines while excesses built up in our financial markets – and that led to a devastating crash. We are doing the same thing on climate change, he says.

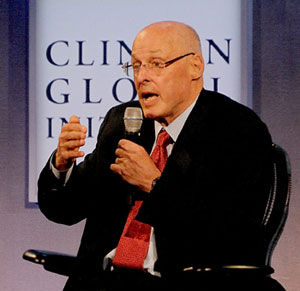

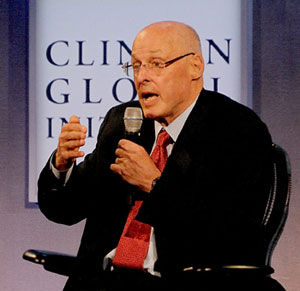

At last weeks’ 2014 Clinton Global Initiative, Paulson spoke on the panel "Confronting Climate Change Is Good Economics," along with Helle Thorning-Schmidt, Prime Minister of Denmark. Judith Rodin, President of The Rockefeller Foundation, served as moderator.

The essence of his message is that "Climate change is the single biggest risk to the global economy today." The solution he says once again, is to put a price on carbon.

Why? Because fundamental changes in US policy are necessary and a tax is an effective way to reshape the economics that surround climate change, he says.

credit: Karen Rubin

Journalist Karen Rubin attended the panel and gave us these excerpts:

"Businesses and investors should look at the issue of climate change through an economic lens: What are the economic risks of doing nothing? What are benefits if we factor Climate Change into decision making and actions?"

As part of the nonprofit Risky Business, he took a "granular look" at the US by region and

industrial sector, and concluded that the likely scenario for coastal areas in the next 15 years is "damages from storm surges will increase by third; crop yields in states like Illinois and Indiana, decline by 50-70%, high temperatures make it difficult to work outdoors…"

Businesses need to incorporate assessments like this these into their decision making, thinking long-term. "If they don’t invest properly, there will be huge costs for shareholders to pay."

"Businesses need to be careful where they build and buildings need to be hardened to withstand storms."

"Investors will increasingly demand disclosures, and businesses need to get ahead of this. Their job is to analyze risk regarding not just where they are today, but what they might face in the future and what public policy will be – otherwise they could find themselves with stranded assets, he says.

He points to signs that businesses are beginning to take climate change into account. The NY utility Con Edison, for example, plans to spend up to $5 billion to harden power lines and infrastructure, and Colgate has already relocated 30 plants that were vulnerable to damage.

There are plenty of examples of businesses making investments in efficiency, green buildings, more efficient fleets – but they won’t go far enough without policies that provide stable, predictable incentives.

Indeed, "Short term thinking is the enemy. I want to scream out ‘bull shit’ to people who question if it makes economic sense to plan based on climate."

"I heard the same about the Clean Air Act. People need to realize that the only way to build long term prosperity and competitiveness is by taking a longer-term approach. Short term is the enemy.

From his time in Washington, Paulson found that government does a poor job of focusing on controversial, difficult complex issues if they are longer term in nature. It has to be a full-blown crisis to get serious attention.

It’s been said many times now, but Paulson called for it again: "We need a national policy to unleash the markets, unleash innovation, that will lead to new technologies and change

behavior – business and consumer behavior. The only way, and the best way to get there is by putting a price on carbon,"

he said to applause. "We can debate how to do it – how to structure it, price it, what to do with the revenues, but we must get on with it."

++++

At the concurrent UN Climate Summit, the US did not join the 73 countries, 22 states, provinces and cities – who signed a declaration calling for an international price on carbon, either through a tax or cap-and-trade program. Over 1,000 businesses and investors also signed.

And 340 of the biggest investment managers issued their own statement.

Loading...

Loading...

The end game question is this:

Which is more desirable; an Ice House planet or a Hot House planet (like Earth has been for most of its history)?

This article makes false claims about the dynamics of a warmer planetary climate btw.